To help clients solve retirement income needs over time, our Protective® Variable Annuity II B Series offers SecurePay 5, a protected lifetime income benefit for benefit base growth early on and guaranteed income later.

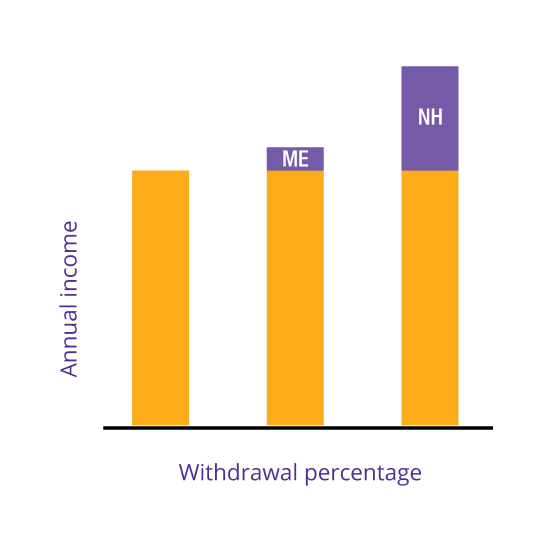

Deliver more income with our enhanced withdrawal rates

SecurePay 5 benefit helps you maximize clients' income with strong annual withdrawal percentages. Contact our sales desk or view full rate details to learn how you can deliver more to your clients with this competitive rider.

Benefits that add up to a lifetime of protection

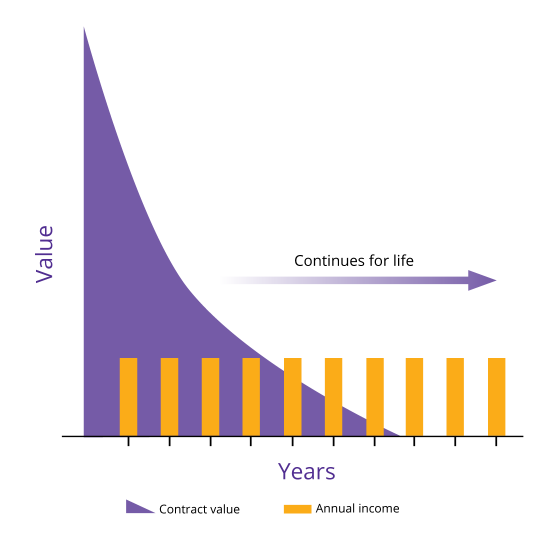

Adding SecurePay 5 benefit to our Protective Variable Annuity II B Series combines enhanced benefit base growth with guarantees to ensure a protected lifetime income benefit that retirees won’t outlive and adjusts to their changing needs.

Review our enhanced annual withdrawal rates

The annual withdrawal percentage is based on the age at which the client begins withdrawals and whether they choose a single or joint payout.

Issue Age

60-64

65-66

67-69

70-71

72+

Single Person

4.15%

4.90%

5.15%

5.45%

5.70%

Both Spouses

3.65%

4.40%

4.65%

4.95%

5.20%

SecurePay 5 benefit delivers value to your clients at various life stages

Available with our Protective Variable Annuity II B Series, SecurePay 5 offers guaranteed growth of the benefit base during pre-retirement, guaranteed annual withdrawals for life, and available enhanced benefits for additional care needs.

Customize a retirement investment strategy with SecurePay 5 benefit

We offer access to investment options of varying asset classes. Emphasis is on quality, with many featuring a long track record of performance. Use these tools to see how SecurePay 5 benefit can provide a more tax-efficient and customizable retirement strategy.

Helpful resources

Want to learn more about how the SecurePay 5 benefit or nursing home enhancement can support your client's retirement strategies? Download these helpful resources.

Other related topics

Combine growth, income and legacy protection with Protective%%®%% Variable Annuity II B Series

Enhanced death benefit options for legacy protection

Fund performance resources and tools

We're here for you

Everyone deserves peace of mind when it comes to safeguarding what’s most important. We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

¹ If on a contract anniversary, the contract value is less than 50%of the current benefit base, the 5% guaranteed growth rate will be suspended during that contract year, and the benefit base will remain unchanged. The 5% guaranteed growth rate will continue to be available annually until 10 benefit base increases have occurred or until benefit withdrawals have begun, if earlier.

² Available with SecurePay NH, which is not available in all states.

WEB.3088121.05.22

² Available with SecurePay NH, which is not available in all states.

WEB.3088121.05.22