Guaranteed income stream with Protective%%®%% Income Creator fixed annuity helps support clients’ retirement goals

November 14, 2022

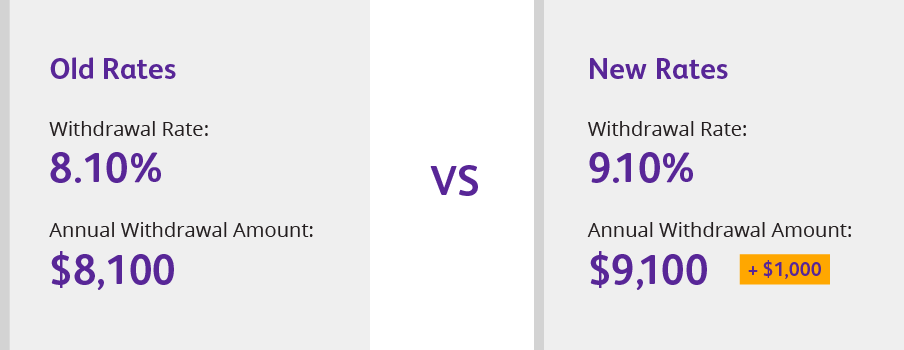

We understand some of the current challenges and potential risks in today's landscape. That's why we're excited to announce enhanced withdrawal rates for the Lifetime Income Benefit available with Protective Income Creator fixed annuity to help clients with retirement goals and increase your sales.

We increased withdrawal rates; here’s what it means for clients

Protective Income Creator fixed annuity offers a simple, cost-effective design with one low annual fee to help support clients' retirement goals. Now, our newly enhanced withdrawal rates offer even higher guaranteed income.We increased our withdrawal rates by 35-75 basis points — creating stronger guaranteed income across a range of retirement ages. For example, a client who purchased Protective Income Creator fixed annuity with a $100K payment at age 60 could see $1,000 more in protected income* with the increased withdrawal rates.

Guaranteed annual withdrawal percentages at key retirement ages*

Issue Age

62

65

67

70

73

Single WD Rates

6.90%

7.20%

7.40%

7.65%

7.95%

Joint WD Rates

6.40%

6.70%

6.90%

7.15%

7.45%

*Lifetime income rates shown at key retirement ages for single persons and spouses are based on the benefit being taken within the first year. See Payout Guide for full details and guaranteed income factors for every age.

Transition rules and key dates to keep in mind

As you consider who in your book of business could benefit from these enhancements, keep these transition rules and key dates in mind.

- New rates will apply to new sales as of November 14, 2022.

- Tickets/Applications dated November 13, 2022, or earlier and received in good order will be issued with the current withdrawal rates:

- Cash/Applications/Any 1035 exchange paperwork related to these new tickets/applications must be received no later than November 28, 2022 (10 business days from effective date).

- Previously submitted Annuity tickets/Applications that are awaiting funding from 1035 exchanges and/or Not In Good Order (NIGO) items will continue to be processed through existing procedures.

- Tickets/Applications for the Protective Income Creator fixed annuity dated November 14, 2022, and after will be accepted and issued with the new withdrawal rates.

Give Protective Income Creator Fixed annuity another look today

Explore our product page to learn more.

Connect with our Annuity Wholesaling Team at 888-340-3428 to discuss further.

Connect with our Annuity Wholesaling Team at 888-340-3428 to discuss further.

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

Protective Income Creator is a fixed, single premium, deferred annuity contract with a limited market value adjustment issued b PLICO in all states except New York under contract form series LDA-P-2013 and state variations thereof. The Lifetime Income Benefit is provided under rider form series LDA-P-6054 and state variations thereof. Contract form numbers, product availability and features may vary by state. Protective Income Creator is issued by Protective Life Insurance Company located in Nashville, TN. All payments and guarantees are subject to the claims-paying ability of Protective Life Insurance Company.

WEB.4269427.10.22

WEB.4269427.10.22

To exercise your privacy choices,

To exercise your privacy choices,