Even with accumulation-focused clients, retirement needs are rarely straightforward. A variable annuity enables you to pair higher growth potential with tax deferral and protection features.

Why offer a variable annuity?

A variable annuity can provide growth potential fueled by market performance and additional benefits like guaranteed lifetime income.

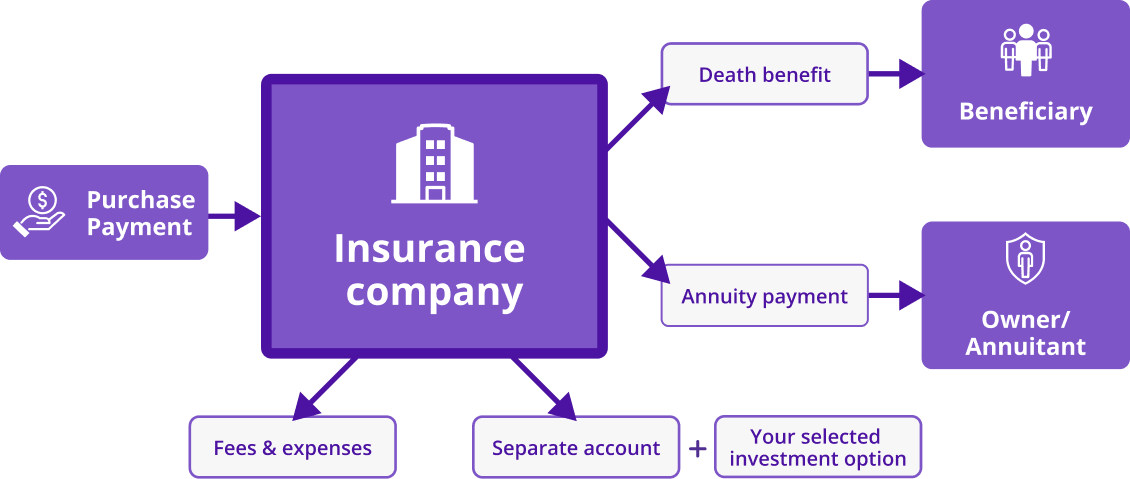

How do variable annuities work?

Variable annuities allocate payments among a choice of investment options or subaccounts. Similar to mutual funds, these subaccounts can invest in a mix of equity, fixed income and other assets for growth. At a future date, clients can elect to receive payments based on the available withdrawal options.

Explore our variable annuity products

Other related topics

Balance growth potential and protection with indexed annuities

Turn clients' assets into reliable income with immediate annuities

Give conservative clients a guarantee with fixed annuities

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Withdrawals reduce the annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals. During the withdrawal charge period, withdrawals in excess of the penalty-free amount may be subject to a withdrawal charge.

Neither Protective nor its representatives offer legal or tax advice. Purchasers should consult their attorney or tax advisor regarding their individual situation.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected income benefit, and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting Protective at 800‐ 456‐6330.

WEB.3147401.09.23

Withdrawals reduce the annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals. During the withdrawal charge period, withdrawals in excess of the penalty-free amount may be subject to a withdrawal charge.

Neither Protective nor its representatives offer legal or tax advice. Purchasers should consult their attorney or tax advisor regarding their individual situation.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected income benefit, and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting Protective at 800‐ 456‐6330.

WEB.3147401.09.23

To exercise your privacy choices,

To exercise your privacy choices,