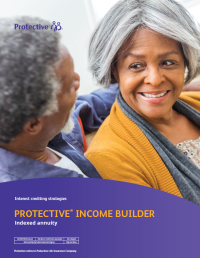

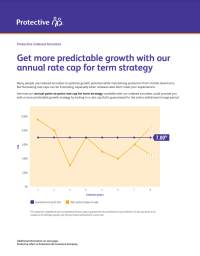

Build retirement confidence with this indexed annuity's predictable, retirement income for life and guaranteed benefit base growth potential.

Why Protective Income Builder indexed annuity?

This fixed indexed annuity offers income protection and the ability to adjust if client needs change.

High guaranteed income opportunities

Ability to customize income strategies

Flexible features for clients' changing needs

Product snapshot

A quick profile of the Protective Income Builder indexed annuity and how it can fit into a client's retirement plan.

Helpful resources on Protective Income Builder indexed annuity

Need a deeper look into product features or resources to help you introduce guaranteed income to your clients? We’ve gathered some helpful resources for you.

Other related topics

Secure a lifetime income source with Protective%%®%% Income Creator fixed annuity

Focus on growth potential and protection with Protective%%®%% Asset Builder II indexed annuity

Why guaranteed income can help support your clients' retirement confidence

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

1 Your Benefit base (the amount on which your benefit withdrawals are determined) is guaranteed to increase by 10% of the total purchase payments every year for up to ten years, or until benefit election, whichever occurs first.

2 Waives withdrawal charges and MVA for contract owners and/or spouses who qualify. May not be available in all states. State variations may apply. Terms and conditions apply.

Withdrawals reduce the annuity’s remaining death benefit, contract values, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½ an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals.

WEB.3026394.03.25

2 Waives withdrawal charges and MVA for contract owners and/or spouses who qualify. May not be available in all states. State variations may apply. Terms and conditions apply.

Withdrawals reduce the annuity’s remaining death benefit, contract values, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½ an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals.

WEB.3026394.03.25

To exercise your privacy choices,

To exercise your privacy choices,