What you need to know about Split Dollar Arrangement Plans

Split Dollar Arrangement Plans have been among the most significant forms of executive benefits for more than 40 years, helping companies attract and retain key executives.

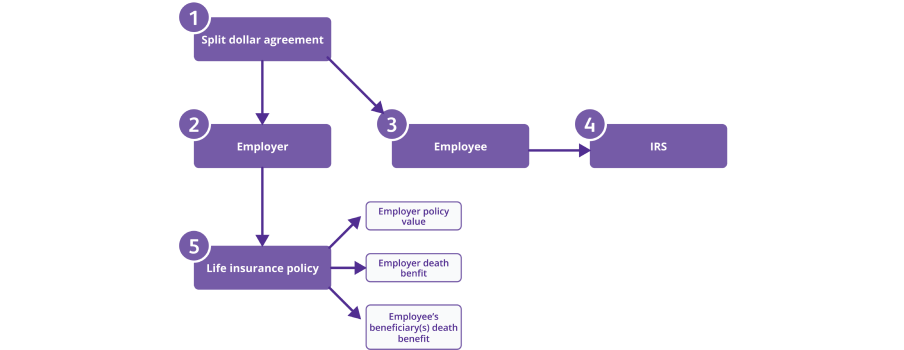

How Split Dollar Arrangement Plans work

The name describes a method of paying for insurance by “splitting” the premiums and proceeds between an employer and an employee.

2 most common Split Dollar Arrangement Plans

- Economic Benefit Split Dollar Arrangement Plans

Economic Benefit Split Dollar Arrangement Plans are similar to what was known pre-final regulations as the “endorsement” method. The employer has title ownership of the policy and by beneficiary designation assigns most of the death benefit to the employee’s beneficiaries. The “cost” from a tax perspective is tax paid by the employee on the “economic benefit” of having the net death benefit payable to the personal beneficiary.

Since the policy and all the cash value belong to the employer, there is no “employee equity.” If the employee has any access (whether actual or deemed) to policy cash values, the regulations provide for taxation of those amounts to the employee. It is also possible to structure a plan under this regime with tax consequences as outlined above where the employee or an irrevocable life insurance trust has title ownership to the policy and retains only the death benefit in excess of the greater of the employer’s premium payments or the policy cash value (formerly known as “non-equity collateral assignment method”.) - Loan Regime Split Dollar Arrangement Plans

This arrangement typically involves a series of loans from the employer to the employee. The loans are used as the source of premium payments. Under the IRS regulations on split dollar, the loan should bear interest based on the Applicable Federal Rate (AFR), which may depend on the term of the loan, but legal counsel should be consulted on selection of the rate.

In a low interest rate environment, making this plan particularly attractive when using short-term loans and demand loans. How the loan rate is selected depends on a number of factors, including when the parties want to “lock-in” the current rates for a period of years (i.e., up to 9 years for mid-term rate, and over 9 years for long-term rate). On the other hand, the parties may consider using the published “blended rate” for a demand note, which may or may not be lower than the “short-term” AFR.

The advantage of the “blended rate” is that the lender can reset the rate every year, rather than lock into the short-term rate (up to 3 years). That is, the blend rate floats, but comes with a risk the loan interest may increase over time.

Some business owners may prefer to ensure predictability of the interest rates (and corresponding the tax consequences of the split dollar arrangement) and, accordingly, may prefer using the term rate from the outset. Another concern with a demand note is that it provides the employer an unfettered right to accelerate full payment of the loan. That is a risk some employees would not want to assume. Again, these elements of loan regime split dollar are matters that the employer and employee should address with their respective tax advisors.

Other related topics

Deferred compensation delivers tax advantages

Executive bonus plans: leverage tax benefits

Protect the future success of your client’s business

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

In 2006, Congress enacted §101(j) to impose an income tax on the death benefits of employer‐owned life insurance policies (in excess of premiums paid)—unless specified conditions are met prior to issuance of the policy.

Purchasers should consult with their legal or tax adviser regarding their individual situations before making any tax related decisions.

These materials contain statements regarding the tax treatment of certain financial assets and transactions. These statements represent only our current understanding of the law in general and are not to be considered legal or tax advice by purchasers. Business tax rules and the tax treatment of life insurance are subject to change at any time. Neither Protective Life nor its representatives offer legal or tax advice.

WEB.3147177.09.21

Purchasers should consult with their legal or tax adviser regarding their individual situations before making any tax related decisions.

These materials contain statements regarding the tax treatment of certain financial assets and transactions. These statements represent only our current understanding of the law in general and are not to be considered legal or tax advice by purchasers. Business tax rules and the tax treatment of life insurance are subject to change at any time. Neither Protective Life nor its representatives offer legal or tax advice.

WEB.3147177.09.21

To exercise your privacy choices,

To exercise your privacy choices,