Boost retirement confidence with guaranteed income

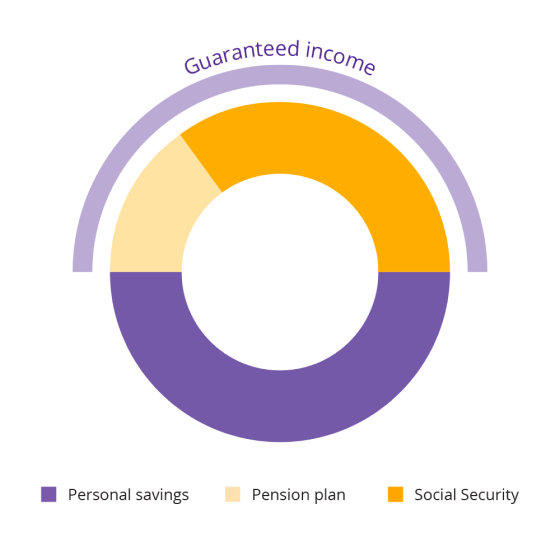

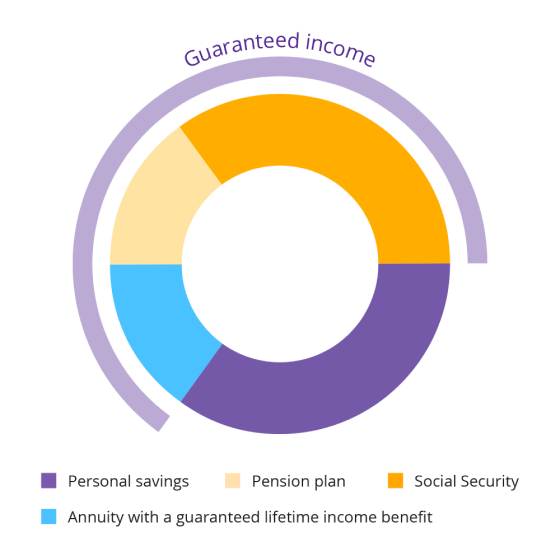

Clients can feel more confident in the future they've worked hard for when a portion of retirement income is derived from guaranteed sources. Start a guaranteed income conversation with your clients and help them protect their vision for retirement.

3 benefits of guaranteed income for clients

Build more confidence with a guaranteed income solution

Guaranteed income solutions, like annuities, can help clients feel more confident in the long-term viability of their retirement plan. See how leveraging an annuity can protect retirement income and secure funding for inflexible retirement expenses.

Use this 3-step income planning approach with clients

Employ three easy tactics to strengthen your client's confidence in their retirement plans. Set spending priorities, estimate expenses, and evaluate how flexible their expenses can be. For more on this approach and support to enrich your client conversations, download this white paper by expert Michael Finke.

Explore our guaranteed income solutions

When you've identified a need for guaranteed income in your clients' plans, our suite of annuity solutions can help you deliver a solution that best fits your clients' retirement goals. Explore our options below.

Income soon

Protective® Income Creator Fixed Annuity

Fixed annuity

Protected lifetime income with access to money

Income later

Protective® Income Builder Fixed Indexed Annuity

Indexed annuity

10% benefit base rollup² and competitive withdrawal rates

Income with growth potential

Protective® Aspirations Variable Annuity

Variable annuity

Growth potential, flexible income solutions and enhanced legacy protection

Other related topics

Key decisions in retirement strategy

Risks to consider when accumulating retirement savings

Developing a holistic retirement plan

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

1 David Blanchett and Michael Finke, "Guaranteed Income: A License to Spend," 2021.

2 Your Benefit base (the amount on which your benefit withdrawals are determined) is guaranteed to increase by 10% of the total purchase payments every year for up to ten years, or until benefit election, whichever occurs first.

WEB.3085547.07.23

2 Your Benefit base (the amount on which your benefit withdrawals are determined) is guaranteed to increase by 10% of the total purchase payments every year for up to ten years, or until benefit election, whichever occurs first.

WEB.3085547.07.23

To exercise your privacy choices,

To exercise your privacy choices,