Addressing risks for more confident asset growth

Market-driven investments play a big role in retirement saving, making protection from market declines an ongoing challenge. You can help clients plan for potential accumulation risks to better protect their retirement.

Helping clients understand accumulation risks

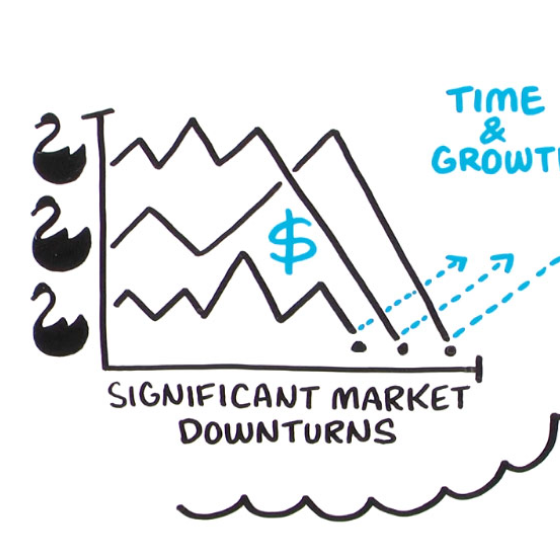

Although many events can inhibit asset growth, think about accumulation risk in two ways:

1. ongoing market volatility, usually frequent but less disruptive

2. sudden, disruptive market volatility due to what are called "black swan events"

Our brochure explores these issues, and more, to help you open the door to protecting their savings.

Resources to support your accumulation risk discussions

As you address risk management in your client conversations, consider our resources. They are designed specifically to initiate important discussions about market volatility and the tools available to protect your clients' hard-earned savings.

Explore our solutions that can help protect against risk

We offer several accumulation-focused solutions that can help mitigate risk and help you better protect your clients' retirement.

Variable annuity

Risk profile: High

Tax deferred growth, guaranteed lifetime income and enhanced legacy protection

Indexed annuity

Risk profile: Moderate

Diverse options for growth optimization

Other related topics

Important risks to consider in retirement planning

Navigating life’s changes for retirement

Key decisions in retirement strategy

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

WEB.3026134.04.22

To exercise your privacy choices,

To exercise your privacy choices,