Retirement income risks you can help clients avoid

There are risks that you can shed light on as part of a holistic retirement planning approach. With a better understanding of these risks and their potential impact, as well as strategies to help protect against them, you can help build your client's retirement confidence. We have resources to help you with each step along the way.

Potential retirement income pitfalls

Use this 3-step income planning approach with clients

Employ three easy tactics to strengthen your client's confidence in their retirement plans. Set spending priorities, estimate expenses, and evaluate how flexible their expenses can be. For more on this approach and support to enrich your client conversations, download this white paper by expert Michael Finke.

Boost your client’s confidence in their income plan

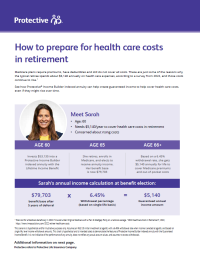

Clients can feel more confident in their plans for retirement when a portion of retirement income is derived from guaranteed sources. Learn how guaranteed income can help you deliver the protection and security that's right for your clients’ retirement goals.

Helpful resources

Download these resources to share with clients how underestimating income risks can impact retirement income, and the protection guaranteed income solutions can offer.

Other related topics

Combine growth, income and legacy protection with Protective%%®%% Variable Annuity II B Series

Risks to consider when accumulating retirement savings

Secure a lifetime income source with Protective%%®%% Income Creator fixed annuity

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

WEB.3144144.12.21

To exercise your privacy choices,

To exercise your privacy choices,