We understand the current challenges and risks in today's landscape. That's why we're excited to announce increased withdrawal rates for the Guaranteed Income Benefit available with Protective Income Builder indexed annuity to benefit customers and your sales.

With rising inflation, higher cost-of-living expenses, and leaner returns on investments, many Americans feel less secure about their ability to stay on track with their financial and retirement goals.

According to Country Financial's March 2022 Security Index, about nine in 10 Americans are now concerned about inflation, and six in 10 are "very concerned," up from 48 percent during the fourth quarter of 2021.

The survey, which interviewed 1,023 adults in the United States from March 18-20, also found that over 50 percent believe surging costs may have a "big negative impact" on plans like buying a house or being adequately prepared for retirement.

We understand the current challenges and risks in today's landscape. A solution like Protective Income Builder indexed annuity can help customers secure their retirement income. That's why we're excited to announce we've increased withdrawal rates for the Guaranteed Income Benefit available with Protective Income Builder indexed annuity effective May 23, 2022. It's one more way we're enhancing our products to reflect the needs of customers.

We increased withdrawal rates; here's what it means for customers

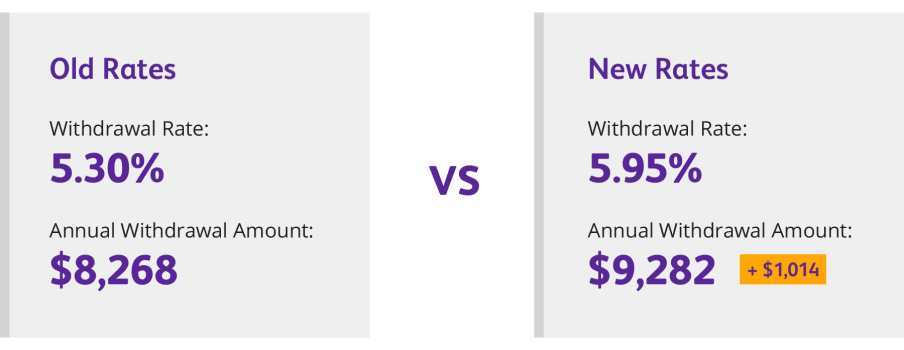

To offer stronger guaranteed income opportunities across a range of retirement ages, we increased our withdrawal rates by 50 to 105 basis points. A customer who purchased Protective Income Builder indexed annuity with a $100K payment at age 60 could see about $1,014 more in protected income* with the increased withdrawal rates.

A breakdown for single and joint life plans%%1%%

Transition rules and key dates to keep in mind

As you consider who in your book of business could benefit from these enhancements, keep these transition rules and key dates in mind.

- New rates will apply to new sales as of May 23, 2022.

- Tickets/applications dated May 22, 2022 or earlier and received in good order will be issued with current withdrawal rates.

- Cash/application/any 1035 exchange paperwork related to these new tickets/applications must be received no later than June 6, 2022 (10 business days from effective date).

- Previously submitted annuity tickets/applications that are awaiting funding from 1035 exchanges and/or Not In Good Order (NIGO) items will continue to be processed through existing procedures.

- Tickets/applications for the Protective Income Builder indexed annuity with the Guaranteed Income Benefit dated May 23, 2022 or later will be accepted and issued with the new withdrawal rates.

Give Protective Income Builder indexed annuity another look today

Explore our product page to learn more.

Connect with our Annuity Wholesaling Team at 888-340-3428 to discuss further.

For Financial Professional Use Only. Not for Use With Consumers.

WEB.3845062.05.22

To exercise your privacy choices,

To exercise your privacy choices,