A desire for 75% of workers is to have at least half of their retirement income guaranteed. However, many might be falling short of this goal — even with Social Security benefits.¹ Your clients may not realize all the variables that can impact their Social Security benefits. Things like timing, taxes and Medicare costs have the potential to influence your clients’ unique situations. The good news: This is a great opportunity for you to help guide decisions and offer solutions to help clients obtain the level of guaranteed income they desire.

Here’s a closer look at things that can impact Social Security benefits before and after your clients file — and a strategy to help protect them.

Set clients up to receive the highest Social Security benefit possible

Protect their level of guaranteed income once benefits begin

Build confidence through key retirement decisions

Set clients up to receive the highest social security benefit possible

When it comes to Social Security benefits and retirement, age 67 is the new 65. But, for many people, delaying retirement until full retirement age, or later, is not an option. In fact, more than half of retirees report retiring earlier than planned — and often not by choice.¹ With concerns about potential reductions in Social Security, attaining the highest level of benefits possible can help them feel more confident about the future.

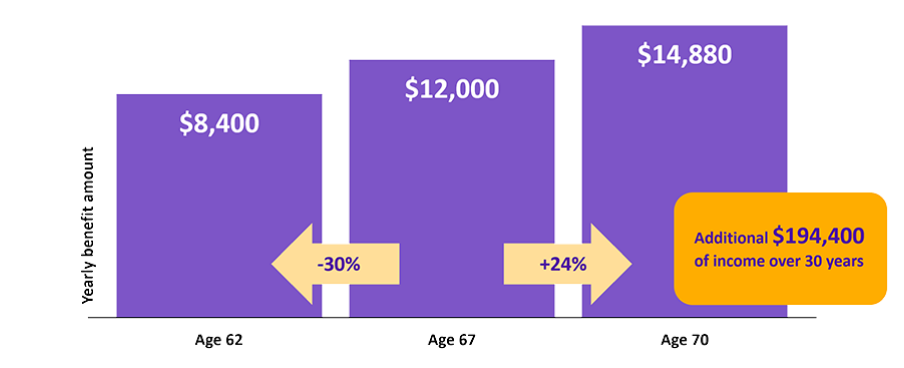

Just how much difference can a couple of years make?

The cost of filing sooner than later is substantial for your clients. Especially when you consider the total amount of guaranteed income gained (or lost) throughout their retirement. The example below assumes annual benefits of $12,000 per year ($1,000 a month) if the client, born in 1961, filed at full retirement age. Delaying Social Security benefits until age 70 could mean almost $200,000 more in retirement income.

Here’s a strategy to help clients delay filing for Social Security benefits

Some clients may not think a delay in filing to maximize Social Security benefits is an option, because they’ll need that income right when they retire.

An annuity that offers guaranteed lifetime income can help in two ways:

- In the short term it may bridge the income gap, enabling clients to retire when they want AND still postpone filing until they reach full retirement age, or even age 70, to maximize their Social Security benefits.

- In the long term, it strengthens their overall retirement strategy by increasing the percentage of their income that is guaranteed for life.

Protect their level of guaranteed income once benefits begin

Clients may not realize how much of an impact taxes and Medicare can have on what they actually receive in Social Security benefits — and their retirement confidence. By making up the difference with income that is also guaranteed, you can help them maintain both.

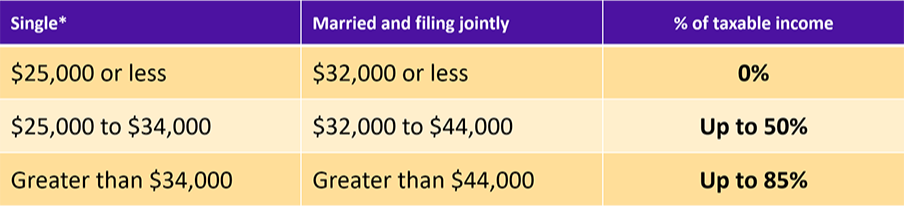

Social Security benefits may be taxable

According to the Social Security Administration, over half of people receiving benefits will pay taxes on them. While money withdrawn from an IRA, pension or other investment may not be considered earnings, they may impact how your clients’ benefits are taxed.

Here’s how much is taxable based on income amount and IRS filing status.

Medicare Part B premiums are deducted from Social Security benefits

Clients may be surprised to know that their Medicare Part B costs are automatically deducted from their Social Security benefits. Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Clients can expect their Social Security benefit to be reduced, sometimes by a few thousand dollars annually, depending on their Part B costs.

Here’s a strategy to help clients protect their level of guaranteed income

Here again, an annuity with a guaranteed lifetime income benefit can help limit the impact of taxes and premium costs. After clients start receiving Social Security benefits, payments from an annuity would help cover reductions in those benefits due to taxes and Medicare premiums.

Income from the annuity can also be used to:

- Supplement future lifestyle goals.

- Pay for unexpected health care expenses not covered by Medicare.

- Plan for rising costs in retirement with a solution that offers withdrawal payments that increase over time.

Ultimately, this strategy can help clients maintain — or even increase — their guaranteed income.

Build confidence through key retirement decisions

We’re here to support your strong client relationships with strategies to help meet their holistic needs. Understanding issues that can impact Social Security benefits is just one part of helping clients approach Social Security decisions. We have Social Security resources to support you and your clients at every step.

As you guide clients through more of their key retirement decisions, explore additional topics that may influence their strategies:

Annuities are intended as vehicles for long-term retirement planning, which is why withdrawals reduce an annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Annuities also may be subject to income tax and, if taken prior to age 59 ½, an additional 10% IRS tax penalty may apply.

This material contains statements regarding the availability of and details surrounding the Social Security program. These statements represent only our current understanding of Social Security in general and is not to be considered legal or tax advice by consumers. Details of the Social Security program are subject to change at any time.

WEB.5146070.09.23

To exercise your privacy choices,

To exercise your privacy choices,