Jim Wagner

Chief Distribution Officer, Retirement Division at Protective

Chances are good you're already pulling several levers in your client's retirement strategy to help ensure they're growing their investments enough now to have the income they need later. But according to Goldman Sachs' 2022 Retirement Survey and Insights Report (read more about the results on their site), 75% percent of retirees are still on a path to fall short of their retirement income goals. So, they might need a strategy to help instill more confidence in their plans.

A solution like Protective® Aspirations variable annuity with the SecurePay ProtectorSM benefit can be a powerful complement to a client's existing retirement strategy. By repositioning a portion of your client's assets to a variable annuity with a living benefit, you can efficiently deliver more guaranteed income potential. Here's how.

Step 1: Purposeful repositioning and setting up a dual strategy

Step 2: See how this dual strategy worked for one client

Step 3: Get started with Protective® Aspirations variable annuity

Step 1: Purposeful repositioning and setting up a dual strategy

While both an existing investment portfolio and a variable annuity can accumulate and distribute assets, you can give each one a unique purpose so they work more efficiently together:

- The investment portfolio can focus on maximizing growth potential.

- The variable annuity can focus on maximizing a guaranteed income stream.

Leveraging the income benefits of a variable annuity can mean your client relies less on their portfolio during retirement. They can more confidently invest their portfolio assets and their income plan is less susceptible to market swings — all thanks to the guaranteed income stream of the variable annuity. Let's explore how this dual strategy can work.

Step 2: See how this dual strategy works for one client

Let's explore how pairing these two strategies can work effectively together to create a more robust retirement income stream for a client.

Meet George. He's 60 years old with $1 million in his investment portfolio and he wants to retire at 65. He'll need $6,250 per month total in guaranteed income to cover his expenses in retirement — but $2,500 of that will be covered by his Social Security.

He meets with his financial advisor to begin thinking about his income distribution plan for the remaining $3,750 he'll need because he's worried about market uncertainty and potentially poor sequence of returns if he relies of his portfolio alone for income. Together, George and his financial advisor decide to pair Protective Aspirations variable annuity with the SecurePay Protector benefit alongside his existing portfolio to help maximize both his growth and guaranteed income strategies.

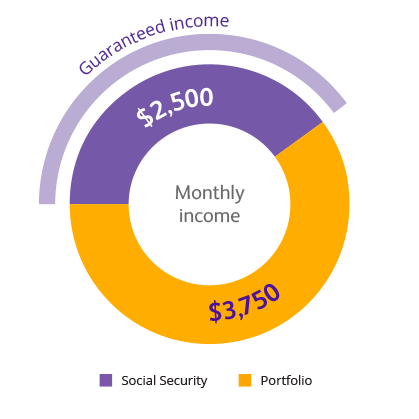

Portfolio alone: 60% reliance rate

George's original plan had him heavily relying on his portfolio for income.

Based on an 8% growth assumption, his portfolio will grow to $1,370,087 by the time he turns 65 — that's a 60% reliance rate. Here's what his income distribution plan would look like if he stayed this course:

- $3,750 in non-guaranteed income from his portfolio alone, based on a 3.3% withdrawal rate

- $2,500 in guaranteed income from Social Security (once he reaches age 70)

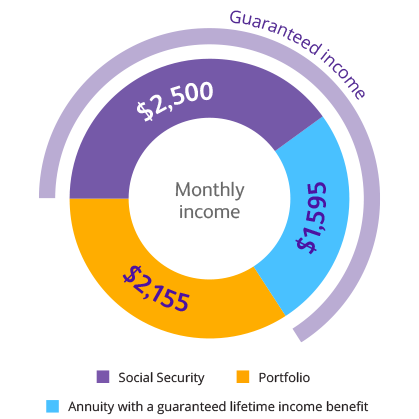

Repositioning $250K into a variable annuity from his $1M investment portfolio means George relies less on his portfolio and gets more guaranteed monthly income.

By age 65, based on an 8% growth assumption, his portfolio and variable annuity contract value total is $1,335,673. The portfolio is prioritized for growth and the variable annuity is prioritized for guaranteed income. Here's what George's $6,250 monthly income plan looks like now:

- $2,155 in non-guaranteed income from a portfolio based on a 2.5% withdrawal rate

- $2,500 in guaranteed income from Social Security

- $1,595 in guaranteed income from his Protective Aspirations variable annuity with the SecurePay Protector benefit

Now George has a more efficient plan to cover his retirement income.

While his original strategy and the new dual strategy both aimed to guarantee George has $6,250/month he'll need in retirement, the dual strategy does it more efficiently. Using the power of Protective Aspirations variable annuity with the SecurePay Protector benefit means George can more confidently stay invested in his portfolio. This dual strategy also increases the percentage of guaranteed income by 64% so George will have that money no matter what the market does. Plus, he has access to all the solution's flexible features to address things like legacy planning, long-term care and chronic illness.

Step 3: Get started with Protective Aspirations variable annuity

Help your client use the strengths of their portfolio and a variable annuity to their advantage.

A solution like Protective Aspirations variable annuity with the SecurePay Protector benefit can be a powerful complement to a client's existing investment portfolio for guaranteeing more income in retirement. This combination offers retirees a stronger retirement income plan that plays to the strengths of both approaches.

Learn how Protective Aspirations variable annuity is designed to deliver more guaranteed income for your clients.

Variable annuities are issued by Protective Life Insurance Company (PLICO), located in Nashville, TN; securities offered by Investment Distributors, Inc. (IDI), the principal underwriter for registered products issued by PLICO, its affiliate. IDI is located in Birmingham, Alabama. Product guarantees are backed by the financial strength and claims-paying ability of PLICO.

Protective Aspirations variable annuity is a flexible premium deferred variable and fixed annuity contract issued by PLICO in all states except New York under policy form series VDA-P-2006. SecurePay Investor benefits issued under rider form number VDA-P-6063. SecurePay Protector benefits issued under rider form number VDA-P-6061. SecurePay Nursing Home benefits issued under form number IPV-2159. Policy form numbers, product availability and product features may vary by state.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit and the underlying investment options before investing. This and other information is contained in the prospectus for a variable annuity and its underlying investment options. Investors should read the prospectus carefully before investing. Prospectuses may be obtained by calling PLICO at 800-456-6330.

WEB.5007932.07.23

To exercise your privacy choices,

To exercise your privacy choices,