Variable universal life insurance (VUL) can offer your clients two important ways to secure what matters most: guaranteed lifetime coverage, plus powerful cash value growth potential to fund a future goal.

Why offer variable universal life insurance?

Your clients who want strong accumulation potential along with guaranteed protection will enjoy these benefits:

Who to consider for a VUL

A variable universal life policy may be a good fit for a client who:

- Is focused on growing their assets tax deferred.

- Is willing to accept more risk to achieve more cash value growth potential.

- Maxed out other vehicles and wants another tax-deferred growth option.

- Has a desire for extras like chronic illness coverage.

Explore our variable universal life solution

Offer clients powerful cash value growth potential to fund a future goal and the protection benefits of life insurance.

Other related topics

Secure what matters with simple, affordable term life

Protect clients with the flexible lifetime benefits of universal life

Tailor protection for unique needs using optional benefits

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

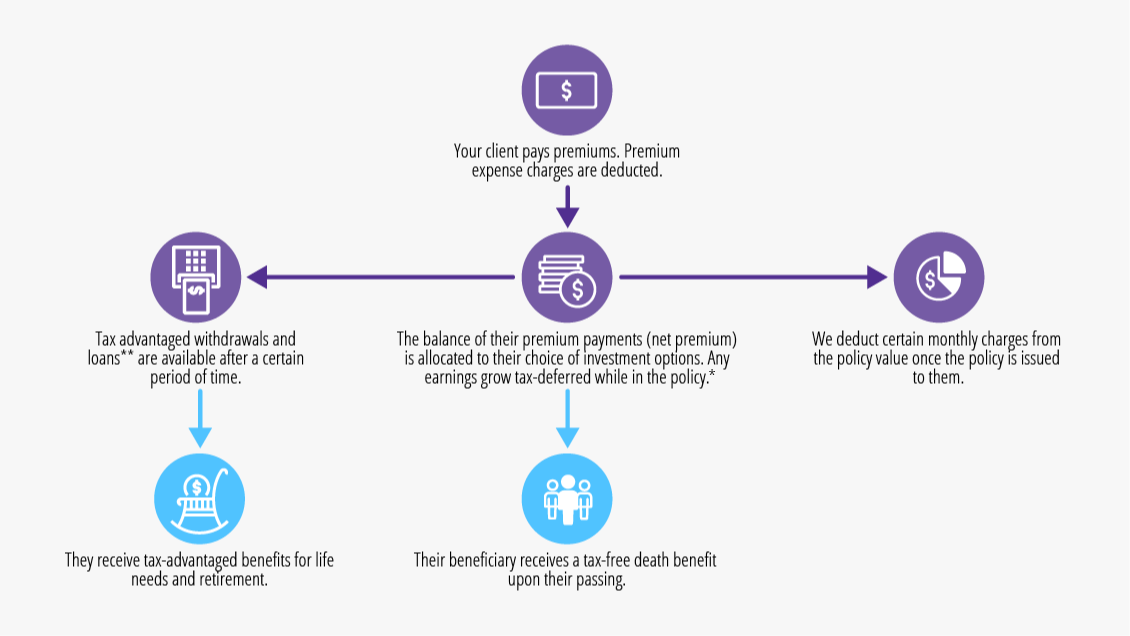

*The Variable Account is subject to the performance of your selected variable universal life investment options. There are investment risks, including the potential loss of principal. Should performance be unfavorable, cash value will decrease, and monthly deductions will increase.

**Though interest is charged on loans, in general, loans are not taxable. Withdrawals are taxable to the extent they exceed basis in the policy. Loans outstanding at policy lapse or surrender before the insured’s death will cause immediate taxation to the extent of gain in the policy. Unpaid loans and withdrawals reduce cash values and policy benefits.

Variable universal life insurance policies issued by Protective Life Insurance Company (PLICO). Securities offered by Investment Distributors, Inc. (IDI), the principal underwriter for registered products issued by PLICO, its affiliate. PLICO is located in Omaha, NE; IDI is located in Birmingham, AL.

Variable universal life insurance involves the risks of investing in stocks, bonds and other securities; market, interest rate and credit risk; and, loss of principle. If the investment performance of underlying investments is poorer than expected (or if sufficient premiums are not paid), the policy may lapse or not accumulate sufficient value to fund the intended application.

Investments in variable universal life insurance policies are subject to fees and charges from both the insurance company and the managers of underlying investments. Loans and withdrawals may negatively impact policy value, investment performance, death benefit, and any Lapse Protection.

Investors should carefully consider the investment objectives, risks, charges and expenses of Variable Universal Life Insurance and its underlying investment options before investing. This and other information is contained in the prospectus for a Variable Universal Life Insurance Policy and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting PLICO at 800-456-6330.

WEB.3147793.01.26

**Though interest is charged on loans, in general, loans are not taxable. Withdrawals are taxable to the extent they exceed basis in the policy. Loans outstanding at policy lapse or surrender before the insured’s death will cause immediate taxation to the extent of gain in the policy. Unpaid loans and withdrawals reduce cash values and policy benefits.

Variable universal life insurance policies issued by Protective Life Insurance Company (PLICO). Securities offered by Investment Distributors, Inc. (IDI), the principal underwriter for registered products issued by PLICO, its affiliate. PLICO is located in Omaha, NE; IDI is located in Birmingham, AL.

Variable universal life insurance involves the risks of investing in stocks, bonds and other securities; market, interest rate and credit risk; and, loss of principle. If the investment performance of underlying investments is poorer than expected (or if sufficient premiums are not paid), the policy may lapse or not accumulate sufficient value to fund the intended application.

Investments in variable universal life insurance policies are subject to fees and charges from both the insurance company and the managers of underlying investments. Loans and withdrawals may negatively impact policy value, investment performance, death benefit, and any Lapse Protection.

Investors should carefully consider the investment objectives, risks, charges and expenses of Variable Universal Life Insurance and its underlying investment options before investing. This and other information is contained in the prospectus for a Variable Universal Life Insurance Policy and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting PLICO at 800-456-6330.

WEB.3147793.01.26

To exercise your privacy choices,

To exercise your privacy choices,