In an ever-evolving estate tax landscape, helping clients prepare now is essential for long-term wealth preservation. Estate planning can provide needed protection for beneficiaries, reduce estate taxes and preserve the legacy clients have worked hard to build.

Why estate plans are important to clients and your business

Estate planning solutions help clients efficiently transfer their wealth to loved ones. You can help clients build a proper estate plan strategy and create growth opportunities for your business by incorporating this service into your holistic approach. Estate planning provides the following benefits for you and clients:

Benefits to clients

Benefits for your business

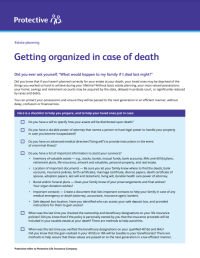

Building blocks of an effective estate planning strategy

As you work with clients to reach their estate planning goals, you can help make the process easier by breaking it down into these essential components:

Life insurance is essential to estate planning

Life insurance relieves the financial stress on beneficiaries. It helps your client’s family meet their day-to-day needs with income, immediate access to cash, tax advantages and more.

Helpful resources

Use these resources to help clients start building their estate, protect beneficiaries, prepare for the future and mitigate estate tax liability.

Other related topics

Legacy planning to protect what clients pass on

Charitable giving that extends clients' legacies

Strategies to transfer wealth efficiently through life insurance

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

WEB.3146729.06.24

To exercise your privacy choices,

To exercise your privacy choices,