Variable annuities: a great option for tax-deferred growth

Helpful resources for tax strategy planning

Other related topics

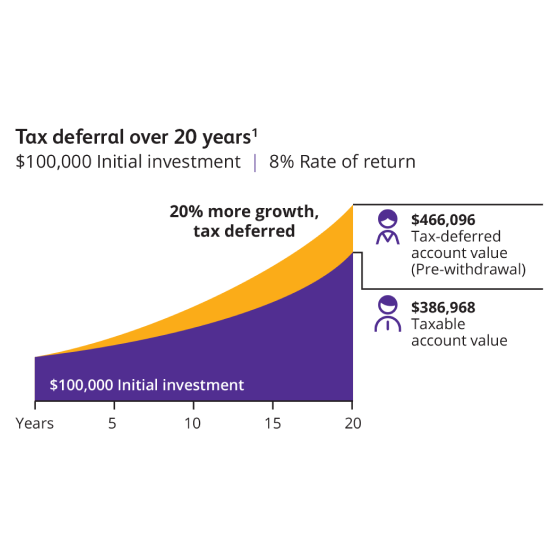

¹ Assumes a 19.5% effective tax rate and standard deduction for filing jointly.

Neither Protective Life nor its representatives offer legal or tax advice. Purchasers should consult with their legal or tax adviser regarding their individual situations before making any tax related decisions.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit, and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting Protective at 800-265-1545.

WEB.3142071.09.21

To exercise your privacy choices,

To exercise your privacy choices,