Indexed universal life insurance (IUL) can help your clients secure their goals with guaranteed protection, plus market-linked cash value growth potential they can access during their lifetime.

Why offer indexed universal life insurance?

Your clients who want permanent protection plus growth potential will enjoy these benefits:

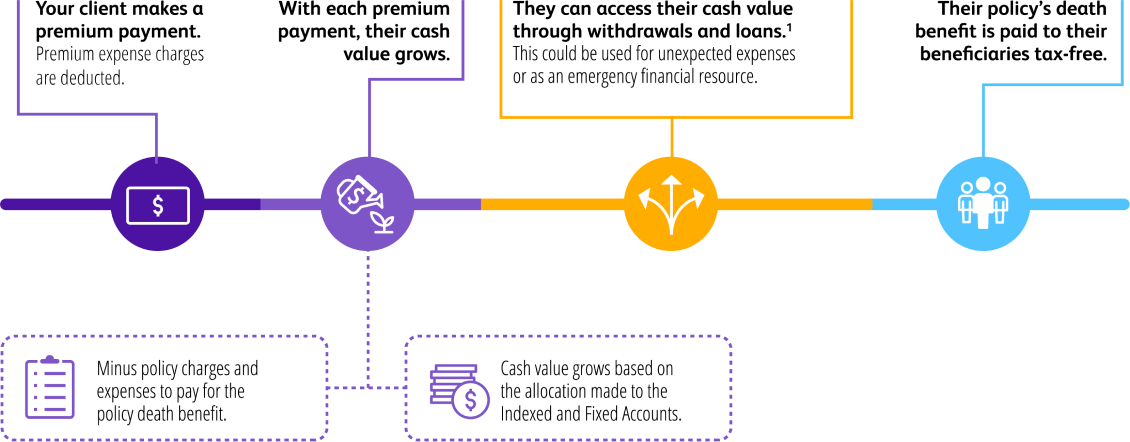

See how an IUL works

Look below for a helpful guide to how an IUL works and use our Indexed Universal Life 101 flyer to help your clients understand it, too.

Recommend our IUL when your clients want protection plus cash value

Protective Indexed Choice℠ UL can protect your clients’ goals while offering flexibility to adapt to life’s changes – including the opportunity to grow and access cash value that’s linked to market performance.

Other related products

Secure what matters with simple, affordable term life

Enhance growth potential and protection with variable universal life

Whole life for immediate protection that lasts a lifetime

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

WEB.3147737.09.21

To exercise your privacy choices,

To exercise your privacy choices,