Aaron Seurkamp

Senior Vice President and President, Retirement Division

Uncover opportunities to prioritize goals amid uncertainty

Missed opportunity #1: Key growth from market rebounds

Missed opportunity #2: Uncapped growth potential to reach objectives

Missed opportunity #3: Access to value that's worth the cost

Offer a variable annuity that delivers more

Uncover opportunities to prioritize goals amid market uncertainty

Clients bring their concerns and their goals to every retirement discussion, and they look to you to address both in their portfolios. When a conversation is focused on today's uncertainties and their fear of loss, giving them a sense of safety with fixed solutions may take priority.

But when you focus on the long-term view, will sidelining more of their portfolio in a fixed solution limit growth opportunity and flexibility to reach their objectives? Their needs may be more aligned to a solution that combines market exposure, safe guaranteed income distribution and value-added benefits – like a variable annuity.

Whether a client brings worries about volatility, fear of losing control of their money or another uncertainty to the table, you can steer the conversation toward a solution that prioritizes their goals while balancing their concerns. It starts with understanding tradeoffs that could be made when a desire for safety leads to sidelining money in a fixed solution. Uncover these 3 opportunities so you can deliver more confidence in a retirement strategy that suits a client's needs, and position yourself as their trusted resource.

Missed opportunity #1: Key growth from market rebounds

Market volatility can rattle even a high-risk tolerant client, so it's understandable that today's environment can leave many people feeling defensive. Your clients may want to prioritize lower risk and lean toward solutions like fixed-indexed annuities or sideline a portion of their money into a CD or money market fund. While this strategy can shield their investment from market drops, help them understand they could trade off powerful growth potential that comes with market rebounds.

Even with this knowledge, your clients may want to play it safe. They might plan to work longer or "unretire" down the road if they come up short on the retirement income they need. But it's important to share that this isn't always an option. Up to 54% of people retire earlier than planned, and not by choice.¹

Uncover the opportunity

When growth and income are a client's key objectives, and their risk tolerance and time horizon align with a variable annuity consideration, you can help ease their concerns. Share why sidelining money in a fixed solution can keep them from the growth they need to reach their objectives. Time in the market, rather than trying to time the market, is the most efficient way to capitalize on market gains.

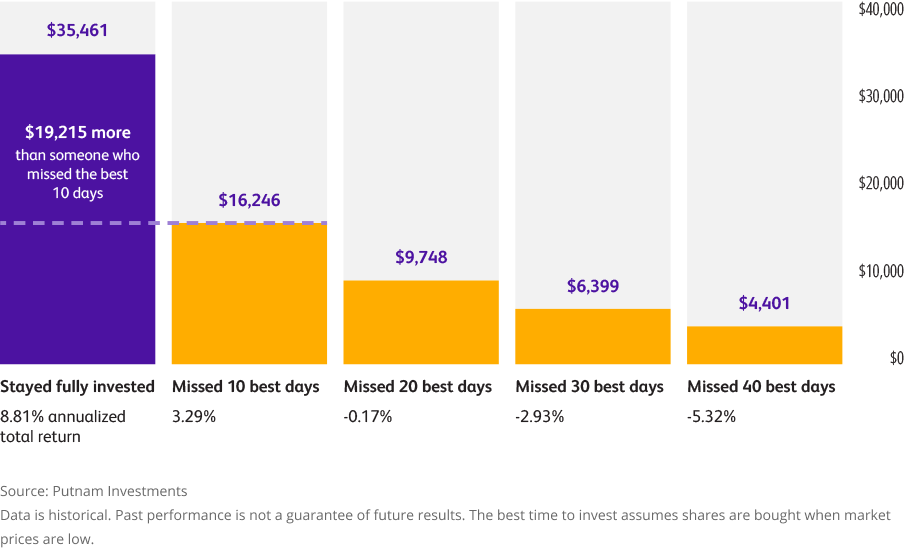

Start by reminding your clients that the stock market routinely recovers – and even moves higher – over long-term periods. Staying invested, even during downturns, allows them to potentially earn more than those who have missed even a small number of the market's best days.

Show clients that missed days affect stock market returns over time.

Here's how $10,000 invested in the S&P 500® performed over a recent 15-year period.²

Missed opportunity #2: Uncapped growth potential to reach income objectives

There's a time and place to prioritize fixed solutions for safety. Ensuring clients are suitably and strategically invested across a variety of vehicles is important, and being too conservative too soon can leave a portfolio short of reaching a client's long-term goals.

When growth and income are the priority, and a client's time horizon and risk tolerance fit a variable annuity consideration, make sure they understand the tradeoffs of sidelining money in fixed solutions. Prioritizing safety, fees, complexity or other concerns can come at the expense of capped growth potential – and ultimately less income in retirement.

Uncover the opportunity

Remind clients that fixed solutions offer downside protection in exchange for a cap rate that limits maximum growth potential. A variable annuity offers uncapped growth potential plus optional living benefits, which can be critical to generating the retirement income they'll need.

You can assure clients that they don't have to cap their growth potential to feel their money is protected. They can stay invested and get a sense of assurance from the high income base of a variable annuity with a living benefit – fueled by strong fund options, guaranteed benefit base growth and competitive lifetime withdrawal rates.

With Protective® Aspirations variable annuity, clients have access to a lineup of over 100 quality investment options, proven by:

- 93% of the funds have more than a 10-year track record.

- 4- or 5-star overall Morningstar Rating™ when an optional protected lifetime income benefit is added.

And with the SecurePay Protector™ benefit, clients can count on guaranteed income for life thanks to:

- 5% compounding benefit base growth even when markets perform poorly.³

- Annual step ups to lock in growth when markets perform well.

- Access to competitive withdrawals, like 6% at age 65 for life.4

Together, high growth potential and a strong guaranteed income strategy can assure clients of their decision to invest using a variable annuity, while mitigating concerns of potentially running out of money in retirement.

Missed opportunity #3: Access to value that's worth the cost

Beyond market uncertainty, clients can be hesitant to commit to products they believe are too expensive or limit their ability to control their investment. These concerns can come from misconceptions that fees, administrative costs or contract provisions of a variable annuity outweigh the benefits in a holistic retirement strategy.

When a client objects to a variable annuity solution because of fee aversion or fear of control loss, you can reframe the conversation. Share the reasons why those fees and conditions exist, while helping them see the flexibility and control these contracts actually offer. Various costs associated with a variable annuity are in exchange for valuable features and levels of protection to meet growth, income and legacy needs in retirement.

Uncover the opportunity

Explain to clients that fees and conditions are only an issue in the absence of value, and the benefits of a variable annuity can be difficult to replicate through other strategies. Protective Aspirations variable annuity is one solution that packs valuable extras to meet multiple objectives.

Flexibility and control for the future

Clients have options for lifetime income and control over their decisions with these features:

- A choice of two protected income benefits for a guaranteed income strategy that fits their specific goals.

- The unique SecurePay ReserveSM option5 allows them to defer income to use however they'd like – whether that's planning a more efficient RMD strategy or preparing for an unexpected health or lifestyle change.

- A built-in enhancement allows them to increase withdrawals up to 10% for five years if they become confined to a nursing home6 (in qualifying states).

- Decisions about the annuity can be made later, like whether to buy an income rider now or in the future, or base withdrawals on single or joint lives.

Legacy planning and protection

When clients are hesitant about both market exposure and product fees, show the value of a variable annuity in growing and protecting their financial legacy. Strong growth potential increases the possibility that their contract value will last beyond retirement and be passed to heirs, which is less likely with a capped growth fixed solution. Pairing a variable annuity next to a fixed product illustration can show the legacy potential difference.

Protective Aspirations variable annuity also has death benefit options that give clients flexibility and control to support efficient wealth transfer. While a standard death benefit helps protect a legacy, an enhanced option offers additional protection and growth opportunities.

Offer a variable annuity that delivers more

Even in times of market uncertainty, stay focused on a client's time horizon, risk tolerance and objectives for growth and income. Sidelining money in a lower-risk solution could leave them short of their long-term goals when a variable annuity could be better aligned to their objectives.

Protective Aspirations variable annuity is designed to deliver more for their strategies with strong growth potential, access to valuable benefits, plus guaranteed income and enhanced legacy options. Together, these benefits drive efficiency and help protect clients' retirement aspirations – and put you in a position to deliver more confidence in their holistic strategies.

² December 31, 2007 – December 31, 2022

³ If on a contract anniversary, the contract value is less than 50% of the current benefit base, the 5% guaranteed growth rate will be suspended during that contract year, and the benefit base will remain unchanged. The 5% guaranteed growth rate will continue to be available annually until 10 benefit base increases have occurred or until benefit withdrawals have begun, if earlier.

4 The 6% at age 65 is for a single lifetime withdrawal rate. The joint lifetime withdrawal rate would be 5.50%.

5 Once withdrawals have begun, the client may take less than their annual withdrawal amount and reserve no more than 1) 3x the annual withdrawal amount or 2) their current account value. May not be available in all states and state variations may apply.

6 SecurePay NH nursing home enhancement may not be available in all states and may not be available with new contracts in the future. To qualify for SecurePay NH, the client must: Be confined to a qualified nursing care facility; be unable to perform two out of six specified Activities of Daily Living or be diagnosed with a severe cognitive impairment; have not been in a nursing home one year before and after purchasing an optional protected lifetime income benefit. Proof of continued qualification is required for each contract year in which this benefit is claimed. May not be available in all states and state variations may apply.

Morningstar Ratings™ are based on risk-adjusted returns. The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its 3-, 5-, and 10-year (if applicable) Morningstar Rating™ metrics. Past performance cannot guarantee future results. Click on the fund name for more information about the fund, including its 3-, 5-, and 10-year (if applicable) Morningstar ratings.

Morningstar % Ranks are based on the total return percentile rank within each Morningstar Category and does not account for a fund's sales charge (if applicable). Rankings will not be provided for periods less than one year. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. Historical percentile ranks are based on a snapshot of the funds as they were at the time of the calculation. Percentile ranks within categories are most useful in those groups that have a large number of funds. For small universes, funds will be ranked at the highest percentage possible. For instance, if there are only two specialty-utility funds with 10-year average total returns, Morningstar will assign a percentile rank of 1 to the top-performing fund, and the second fund will earn a percentile rank of 51 (indicating the fund underperformed 50% of the sample).

Protective Aspirations variable annuity is a flexible premium deferred variable and fixed annuity contract issued by PLICO in all states except New York under policy form series VDA-P-2006. SecurePay Investor benefits issued under rider form number VDA-P-6063. SecurePay Protector benefits issued under rider form number VDA-P-6061. SecurePay Nursing Home benefits issued under form number IPV-2159. Policy form numbers, product availability and product features may vary by state.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit, and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting PLICO at 800-456-6330.

WEB.5007501.07.23

To exercise your privacy choices,

To exercise your privacy choices,