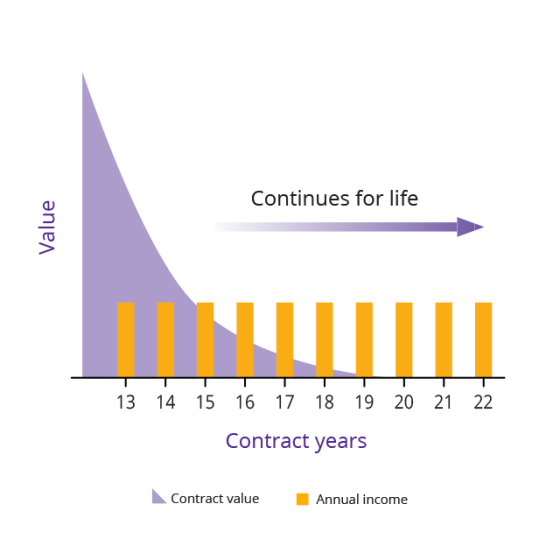

To help clients solve retirement income needs over time, Protective® Investors Benefit Advisory variable annuity1 offers the SecurePay Pro benefit. This optional benefit offers potential benefit base growth and guaranteed lifetime income.

Why add SecurePay Pro benefit to Protective Investors Benefit Advisory variable annuity?

The SecurePay Pro benefit combines potential market-driven growth with guarantees to ensure protected lifetime income that retirees won’t outlive.

How the SecurePay Pro benefit works

More people are retiring earlier than planned, and it’s not always by choice. Whether it’s due to health or employment circumstances, the SecurePay Pro benefit can help create a protected income stream for life.

Discover the built-in nursing home feature available with SecurePay Pro benefit

Help clients prepare for the unexpected with the ability to:

- Access funds to help with nursing home expenses

- Meet long-term care needs with fewer restrictions

- Increase annual withdrawal amounts for up to five years

Investing with SecurePay Pro benefit

Adding the SecurePay Pro benefit to Protective Investors Benefit Advisory variable annuity allows clients to leverage quality investment options. Meet their growth goals and investment risk tolerance with a tailored approach made possible through our multiple allocation options, shaped by guidelines to support guarantees. See the details on our Investing with SecurePay Pro page.

Helpful resources

Want more information about this guaranteed income solution and nursing home benefit? Download our SecurePay Pro benefit and SecurePay NHSM materials.

Other related topics

Tailor a retirement strategy with fee-based Protective%%®%% Investors Benefit Advisory variable annuity

Fund information and performance

Secure a legacy with Protective%%®%% Investors Benefit Advisory variable annuity enhanced death benefits

We’re here for you

Count on us to support you and the way you do business. Reach out to our dedicated RIA support team for help with running illustrations, submitting applications and servicing your fee-based life insurance and annuity business.

1 In New York, the product offered is the Protective® Investors Benefit Advisory NY variable annuity.

2 RightTime is available for an additional 0.1%.

3 SecurePay NH nursing home enhancement is not available in New York. In California, SecurePay NH nursing home enhancement allows clients to increase their withdrawal amounts up to 10%. To qualify for SecurePay NH, the client must be confined to a qualified nursing care facility, be unable to perform two out of six specified activities of daily living or be diagnosed with a severe cognitive impairment, and have not been in a nursing home one year before and after purchasing an optional protected lifetime income benefit. Proof of continued qualification is required for each contract year in which this benefit is claimed. SecurePay NH may not be available in all states and may not be available with new contracts in the future.

4 If your Contract Value is reduced to zero due to benefit withdrawals, your contract will be annuitized and you will begin receiving monthly income payments in an amount equal to your last annual withdrawal amount divided by 12. If your contract value falls to zero due to excess withdrawals the rider will terminate and payments will end.

Protective refers to Protective Life Insurance Company (PLICO), Nashville, TN, and its affiliates, including Protective Life and Annuity Insurance Company (PLAIC), Birmingham, AL. Variable annuities are distributed by Investment Distributors, Inc. (IDI), Birmingham, AL, a broker‐dealer and the principal underwriter for registered products issued by PLICO and PLAIC, its affiliates. Product guarantees are backed by the financial strength and claims-paying ability of the issuing company.

Protective Investors Benefit Advisory variable annuity is a flexible premium deferred variable and fixed annuity contract issued by PLICO in all states except New York under policy form series VDA-P-2006. SecurePay Pro benefits are provided under rider form VDA-P-6057. SecurePay NH is issued under endorsement form series IPV-2159. Policy form numbers, product availability and product features may vary by state.

Protective Investors Benefit Advisory NY variable annuity is a flexible premium deferred variable and fixed annuity contract issued by PLAIC in New York under policy form series VDA-A-2006-500. SecurePay Pro benefits are provided under rider form number VDA-A-6057.

Variable annuities are long‐term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Withdrawals reduce the annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a variable annuity, any optional protected lifetime income benefit and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read prospectuses carefully before investing. Prospectuses may be obtained by contacting Protective at 800-456-6330.

WEB.3143807.07.24

2 RightTime is available for an additional 0.1%.

3 SecurePay NH nursing home enhancement is not available in New York. In California, SecurePay NH nursing home enhancement allows clients to increase their withdrawal amounts up to 10%. To qualify for SecurePay NH, the client must be confined to a qualified nursing care facility, be unable to perform two out of six specified activities of daily living or be diagnosed with a severe cognitive impairment, and have not been in a nursing home one year before and after purchasing an optional protected lifetime income benefit. Proof of continued qualification is required for each contract year in which this benefit is claimed. SecurePay NH may not be available in all states and may not be available with new contracts in the future.

4 If your Contract Value is reduced to zero due to benefit withdrawals, your contract will be annuitized and you will begin receiving monthly income payments in an amount equal to your last annual withdrawal amount divided by 12. If your contract value falls to zero due to excess withdrawals the rider will terminate and payments will end.

Protective refers to Protective Life Insurance Company (PLICO), Nashville, TN, and its affiliates, including Protective Life and Annuity Insurance Company (PLAIC), Birmingham, AL. Variable annuities are distributed by Investment Distributors, Inc. (IDI), Birmingham, AL, a broker‐dealer and the principal underwriter for registered products issued by PLICO and PLAIC, its affiliates. Product guarantees are backed by the financial strength and claims-paying ability of the issuing company.

Protective Investors Benefit Advisory variable annuity is a flexible premium deferred variable and fixed annuity contract issued by PLICO in all states except New York under policy form series VDA-P-2006. SecurePay Pro benefits are provided under rider form VDA-P-6057. SecurePay NH is issued under endorsement form series IPV-2159. Policy form numbers, product availability and product features may vary by state.

Protective Investors Benefit Advisory NY variable annuity is a flexible premium deferred variable and fixed annuity contract issued by PLAIC in New York under policy form series VDA-A-2006-500. SecurePay Pro benefits are provided under rider form number VDA-A-6057.

Variable annuities are long‐term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Withdrawals reduce the annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a variable annuity, any optional protected lifetime income benefit and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read prospectuses carefully before investing. Prospectuses may be obtained by contacting Protective at 800-456-6330.

WEB.3143807.07.24

To exercise your privacy choices,

To exercise your privacy choices,