This fee-based variable annuity solution offers five death benefit options to help clients transfer wealth more efficiently to their loved ones.

5 death benefit options for ensuring a lasting legacy

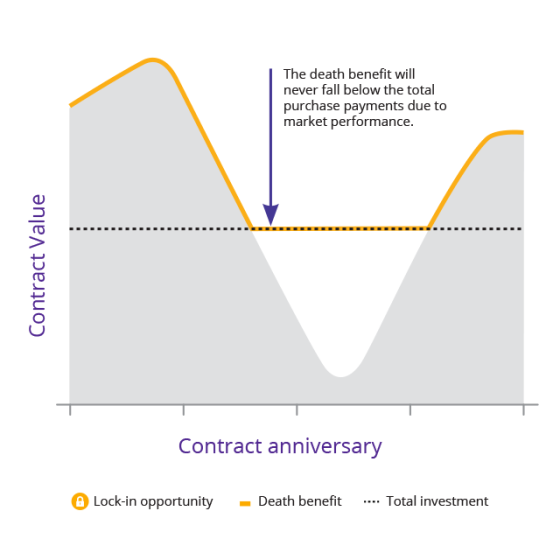

Your clients can choose between a standard or enhanced death benefit option to help them reach their unique legacy planning goals.

See how our enhanced options work to support specific legacy needs

With Protective® Investors Benefit Advisory variable annuity’s four enhanced death benefit options1, it's simple to tailor a legacy strategy to each client's situation.

Other related topics

Tailor a retirement strategy with fee-based Protective%%®%% Investors Benefit Advisory Variable Annuity

SecurePay Pro%%SM%% benefit for optional protected lifetime income

Investing with the SecurePay Pro%%SM%% benefit

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

*Not available in New York

1 The enhanced death benefits are available for an additional fee in lieu of the standard Contract Value death benefit. When a withdrawal is made, an adjustment is made to the death benefit in the same proportion to the amount withdrawn, reducing the contract value. The death benefit option must be selected when the contract is issued and it cannot be changed. If the variable annuity contract is annuitized, the death benefit is no longer payable. If the owner, or the annuitant if a non natural person is the owner, pass away during the annuitization payout phase, the beneficiary may receive additional guaranteed income payments, depending on which payout option is selected.

Protective does not offer or provide investment, fiduciary, financial, legal or tax advice or act in a fiduciary capacity for any client. Clients should consult with their investment advisor, attorney or tax advisor as needed.

Protective Investors Benefit Advisory is a flexible premium deferred variable and fixed annuity contract issued by PLICO in all states except New York under policy form VDA-P-2006. SecurePay Pro benefits are provided by rider form number VDA-P-6057. Policy form numbers, product availability and product features may vary by state. Protective Investors Benefit Advisory Variable Annuity NY is a flexible premium deferred variable and fixed annuity contract issued by PLAIC in New York under policy form series VDA-A-2006-500. SecurePay Pro benefits provided under rider form number VDA-A-6057.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Withdrawals reduce the annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit, advisory fees and the underlying investment options before investing. This and other information is contained in the prospectus for a variable annuity and its underlying investment options. Investors should read the prospectus carefully before investing. Prospectuses may be obtained by calling PLICO or PLAIC at 800-456-6330.

WEB.4004754.07.24

1 The enhanced death benefits are available for an additional fee in lieu of the standard Contract Value death benefit. When a withdrawal is made, an adjustment is made to the death benefit in the same proportion to the amount withdrawn, reducing the contract value. The death benefit option must be selected when the contract is issued and it cannot be changed. If the variable annuity contract is annuitized, the death benefit is no longer payable. If the owner, or the annuitant if a non natural person is the owner, pass away during the annuitization payout phase, the beneficiary may receive additional guaranteed income payments, depending on which payout option is selected.

Protective does not offer or provide investment, fiduciary, financial, legal or tax advice or act in a fiduciary capacity for any client. Clients should consult with their investment advisor, attorney or tax advisor as needed.

Protective Investors Benefit Advisory is a flexible premium deferred variable and fixed annuity contract issued by PLICO in all states except New York under policy form VDA-P-2006. SecurePay Pro benefits are provided by rider form number VDA-P-6057. Policy form numbers, product availability and product features may vary by state. Protective Investors Benefit Advisory Variable Annuity NY is a flexible premium deferred variable and fixed annuity contract issued by PLAIC in New York under policy form series VDA-A-2006-500. SecurePay Pro benefits provided under rider form number VDA-A-6057.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Withdrawals reduce the annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit, advisory fees and the underlying investment options before investing. This and other information is contained in the prospectus for a variable annuity and its underlying investment options. Investors should read the prospectus carefully before investing. Prospectuses may be obtained by calling PLICO or PLAIC at 800-456-6330.

WEB.4004754.07.24

To exercise your privacy choices,

To exercise your privacy choices,